Date: Sunday, 16 October 2022, 11 am to 12.30pm

Venue: Zoom

Do you know how people borrowed money before the banks?

Do you know how big and small businesses during the colonial period meet their financial needs?

Do you know what a Chettiar does?

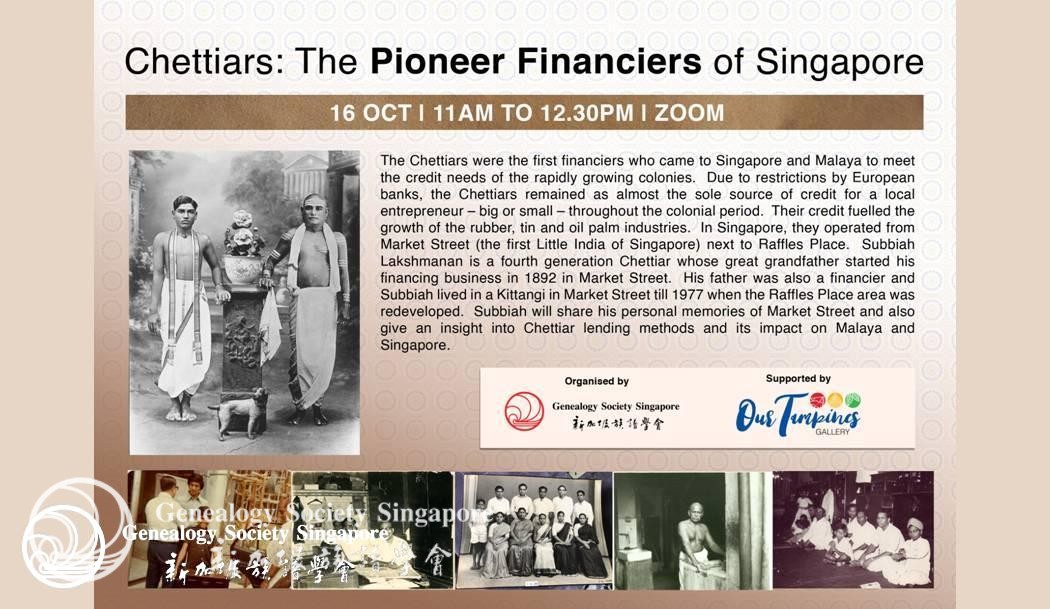

Join us to learn more about Chettiars, the pioneer financiers of Singapore from this free online Zoom talk in English. This event is the fifth session in a series of talks jointly organised by Genealogy Society Singapore and the National Heritage Board.

Registration link: https://forms.gle/D5NbAZvZAU4hr2WZA

Kindly register by Thursday, 13 Oct at 5 pm.

The statistics are as follows:

Total number of registrants from GSS & NHB: 170

Zoom participants: 89

“Congratulations to you and your Programme Task Force for another great success in the Zoom talk this morning. The speaker is very organised and provided lots of information not known to many of us nowadays. I personally have only a vague idea of the Chettiars until today. Please convey my thanks to all involved in this talk.” ~ Ng Yew Kang

“Thanks for the chance to listen to yesterday’s talk. It was rewarding and wonderful, and I hope that you will tell the speaker. Have a good week.” ~ Mike Montesano

“Thank you for the informative talk, it brought the history to life.” ~ Rakhi Shankar

“Thank you Genealogy Society for organising the talk. I’m fortunate to attend the talk.” ~ Karen Chiang

Q1: Where did they get the money? … Were they rich people

A: They brought their original capital from India in 1800s. When European banks like Standard Chartered and HSBC opened branches, they lent the Chettiars as priority clients. The Chettiars then re-lent this in smaller amounts at higher interest rates. They also took deposits from businessmen. In the 1930s, studies indicate that 70% was their own capital, 20% European banks and 10% deposits.

Q2: Hi, may we have the video links and presentation material later.

A: Link will be provided.

Q3: Were there competitors (other than the banks) to the Chettiars?

A: Throughout the 1800s there was no competition and uptill 1960 this was no significant competition. European banks were Merchant and Exchange banks focused on supporting the entreport trade of the colony. They were not looking at SME banking either for investment or working capital. They only lent to European trading firms and some established Asian trading firms. Chettiars DID NOT service European clients. They serviced local SMEs who had no access to banks. Local Chinese banks came in from 1903. But till the 1950s their capital was small, their reach (branches) were few and they mostly serviced established clan members. This changed from the 1960s – especially with the establishment of DBS/Tat Lee/Keppel which were focused at servicing SMEs and government companies. Pawn shops serviced small consumer loans – which the Chettiars did not target. In the early 1900s Sikh and Chinese moneylenders came in – they were also focused on consumer loans of very small size.

Q4: How do the Chettiars communicate with the Chinese as their language is Tamil?

A: Till the 1970s the common language in Singapore was bazaar Malay and many Chinese spoke Malay. Chettiar boys learnt Malay during their apprenticeship. When dealing with colonial authorities they used Indian lawyers to handle the English paperwork.

Q5: Do the Chettiars have clans or associations like the Chiese so new Chettiars can seek help or shelter in a foreign land?

A: They did not have a clan association. But the Chettiars had two key institutions that served similar puroposes – the office-cum-home (Kittangis) all located on Market street and the Tank road temple. Visitors would stay in these places in transit. The community is very small, about 30,000 in the 1930s – so most people were related and would have had some contacts in a big city like Singapore. They also had a Chettiars Chamber of Commerce from 1931 – but this was to lobby the British government.

Q6: Why few Chettiars make Singapore their permanent home?

A: Like other wealthier Indian communities left their families in India and only the men came here as sojourners till the 1950s. Like other Indians they did not see a move to Singapore as emigrating. It was moving within the British Empire (and so like within the same country). After WW2 – due to losses during the war, end of colonial rule and nationalization of businesses in many countries – they decided that it was safer to take their assets back to India. When the Kittangis were closed in 1977 for the redevelopment of Raffles Place area – most firms closed. Today there are about 1000 families of which 95% came from the 1990s as professionals – IT, engineer, accountants, etc.

Q7: What kind of competition was there among the Chettiars?

A: They all operated communally in a Kittangi. It was an open space and everyone knew each others’ clients. In their apprenticeship they are trained to value Unity above all – and not to undercut or poke their nose into others’ affair. Every month a Chettiar committee sets the interest rate to be charged – so all firms have similar rates. If anyone “played dirty” then they will be socially ostracized and even asked to leave the Kittangi.

Q8: How do they safe keep their bundles of cash?

A: They all had safes. They even took deposits from others and safe kept jewels for the public before banks provided these services.

Q9: May know what is that for the default – 10%?

A: About 10% of loans were not repaid and became bad debt. Loans were unsecured in Singapore.

Q10: Can show the slide again on a Day in The Kittangi?

A: You can see it on the video link.

Q11: Did the Guarantor have to pay up when the debtor failed to service the loan?

A: It was on a case-by-case basis. The guarantor was usually already an earlier client of the Chettiar. The Chettiar will manage the relationship as the situation calls for. As a guarantor – the main value is that the Chettiar can ensure that the defaulting client is mostly traceable. Many debts were written off – this indicates that in many cases the Guarantor was not forced to pay the loan eg. Client passes away, business failed, etc.

Q12: Please show the slide of the advantages of the Chettiar?

A: You can see it in the video link.

Q13: Please show the slide of the Day in the life of a Chettiar?

A: You can see it in the video link.

Q14: Is it true the Chettiars did not invest in any property. And eventually most had to return to India.

A: Chettiars were among the largest owners of property in Singapore (together with the Arabs and Jews). Most shophouse properties would have had a mortgage stamp of a Chettiar. They return to India with the end of colonial rule. Please see the answer to question 6 for more details.

Q15: When did the Chettiars start settling in Singapore?

A: They were in Penang in 1819 when Raffles founded Singapore. It is documented that they were in Singapore in 1824. They could possibly have come to Singapore from Penang before this.

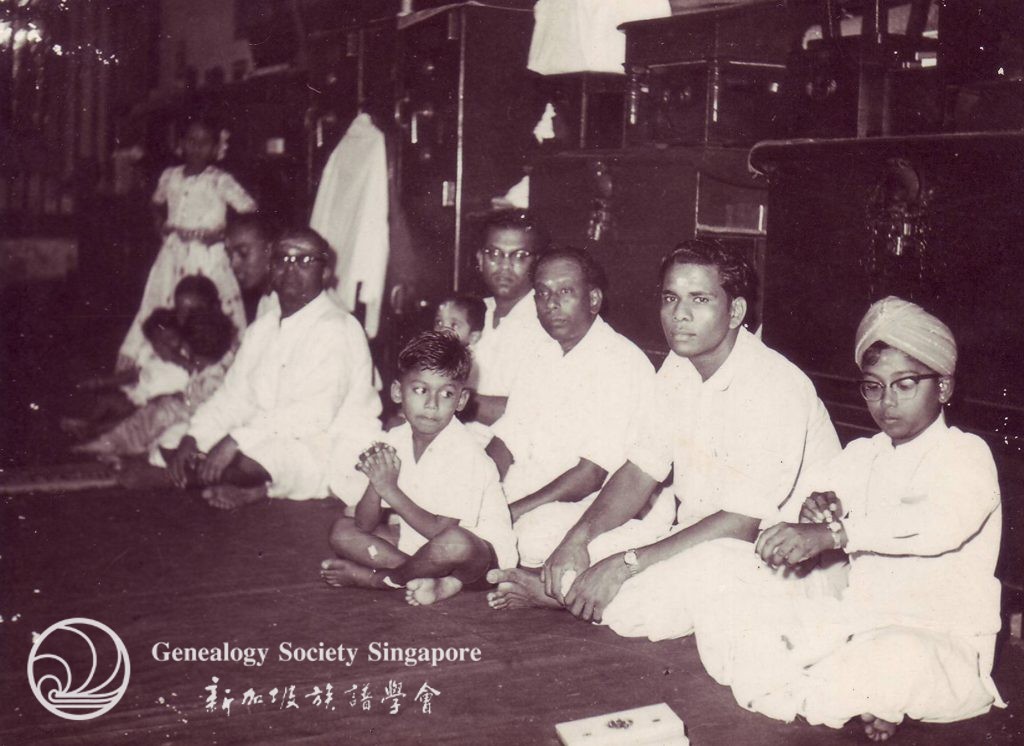

Q16: Did they live at the work premises at Market Street too?

A: Yes the Kittangis on Market Street were offices in the day time and homes at night. There were in-house cooks and laundrymen.